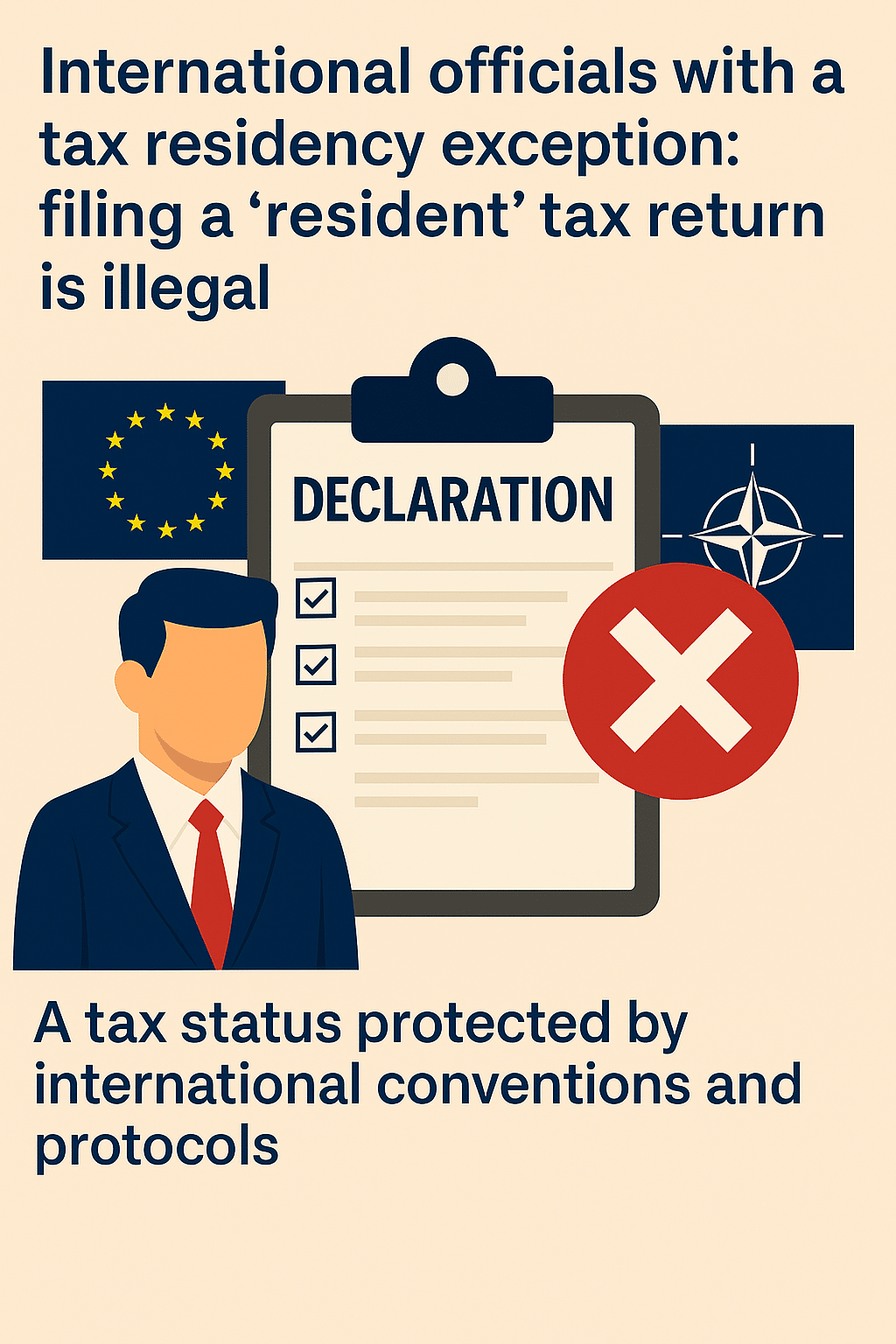

Tax residence and international officials: a little-known exception

As Belgium’s tax return season approaches, many international civil servants (European Commission, NATO, EU institutions, specialised agencies…) receive letters from the Belgian tax administration (SPF Finances) inviting them to submit a “resident” tax return, either online or via a paper form.

However, this request is often inappropriate—or even legally unfounded—for individuals who benefit from a tax domicile exception, as provided for under international conventions and protocols.

Who benefits from the tax domicile exception?

International officials posted in Belgium may, due to their status, be considered fiscally domiciled in another country, even if they reside physically in Belgium.

In practical terms, this means:

- They are not considered Belgian tax residents;

- They are not required to file a Belgian “resident” tax return.

This derogatory tax regime is protected by international treaties to which Belgium is bound.

Why are you still receiving an invitation to declare Your Income?

The Belgian tax administration sends these invitations based on the national population register, which lists all individuals registered with their local commune as residents.

⚠️ This is an administrative—not fiscal—criterion. Being registered at a commune does not determine your tax residence under international tax law.

Often, SPF Finances requests that individuals only complete codes 1062 and 1020, which refer to exempt or foreign income. However:

💡 Belgian law does not allow for partial declarations. Filing one—even with just two codes—may be interpreted as implicit acceptance of Belgian tax residency, contrary to the protections afforded by your international status.

How should you respond to this request?

If you benefit from a tax domicile exception, you are not required to file a resident tax return in Belgium.

We recommend the following steps:

- Email the SPF Finances (p.bru.beheer.gestion@minfin.fed.be) ;

- Clearly explain that you are an international civil servant with a status excluding you from resident taxation in Belgium;

- Attach an official certificate from your institution confirming your fiscal status.

This approach is usually sufficient to halt the request. The administration is acting here out of administrative convenience, without following any legal provision.

Non-resident tax: when does it apply?

Even if you benefit from the tax domicile exception, you may still be liable for Belgian non-resident tax if you earn certain types of income from Belgian sources.

You have no tax reporting obligation in Belgium if:

- You do not receive Belgian real estate income exceeding €2.500 (indexed cadastral value × 1.4);

- You do not earn any taxable professional income in Belgium, other than your exempt international remuneration.

In such cases, no tax return—resident or non-resident—is required.

🎯 Need tailored tax assistance?

Our firm regularly advises international civil servants based in Belgium, particularly those working at EU institutions, NATO, and other international bodies.

Our services include:

✅ Assessment of your actual tax status;

✅ Direct communication with the Belgian tax authorities on your behalf;

✅ Legal assistance in the event of disputes or official notices.

📩 Contact our tax team for a confidential consultation about your fiscal situation in Belgium.